Equity market valuations are broadly reasonable

adjusted for the cyclical low in earnings and

potential for revival going forward.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

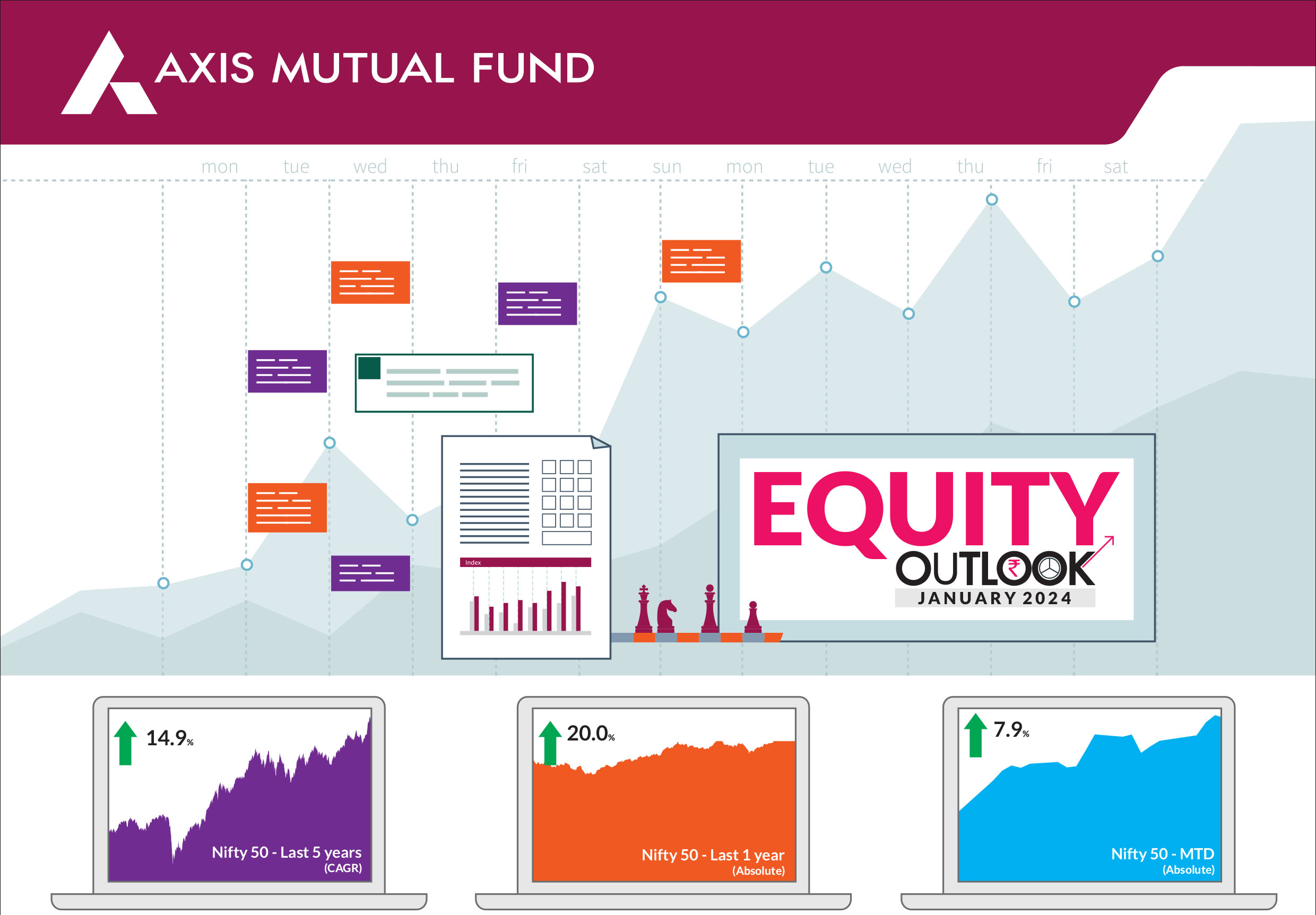

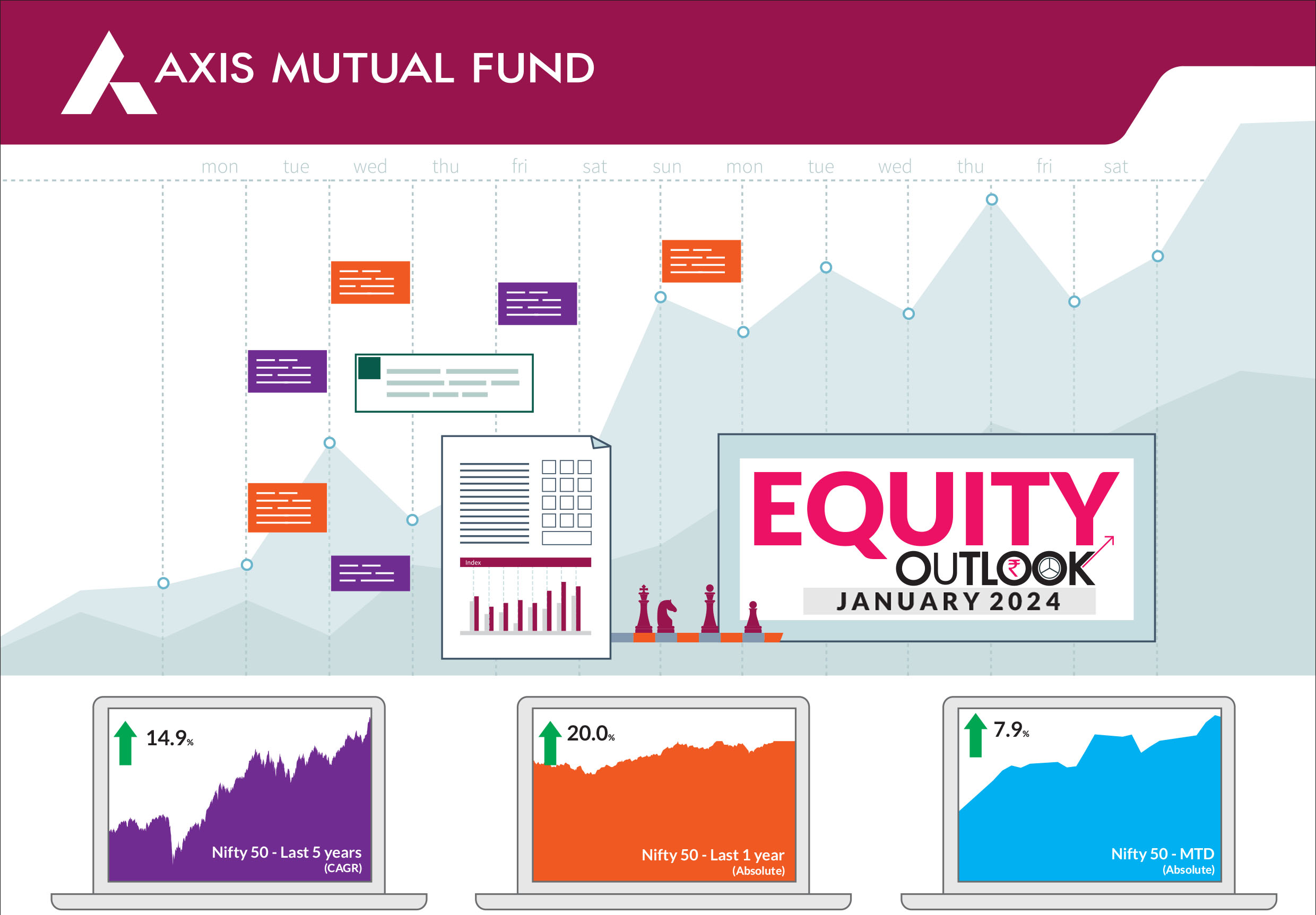

Indian markets ended the year on a strong note with S&P BSE Sensex & NIFTY 50 ending the month higher 7.8% & 7.9% respectively. Although subdued by large caps this month, NIFTY Midcap 100 & NIFTY Small cap 100 ended the month up 7.6% & 6.9% respectively. Key benchmark indices such as the BSE Sensex crossed the 72,000 mark while the NIFTY 50 inched towards the 22,000 mark. All sectors delivered positive absolute and relative returns in December. Market breadth was strong as seen in the advance/decline ratio while volatility was higher compared to the previous month. For the year, the NIFTY 50 & BSE Sensex returned 18.7% and 20% respectively while the NIFTY Midcap 100 & NIFTY Small cap 100 ended on a stellar note advancing 46.6% and 55.6% respectively. This was the eighth consecutive year of positive returns in equities. |

|

The year 2023 turned out to be a year of resilience and strong economic growth catapulting India into a fastest growing country in the world. India also became the fifth country to have a market capitalisation in excess of $4 trn. Headline inflation accelerated to 5.6% in November from 4.9% in October in light of an uptick in food prices and waning base effect. Nonetheless, inflation trends remained subdued and the Reserve Bank of India in its last monetary policy meeting retained CPI estimate at 5.4% for FY24. Indian markets trade at premium valuations in context of long-term averages - both in absolute/relative terms. NIFTY EPS growth expectations for FY24E are 17%/20% and FY25E are 14%/15%. Recent earnings revisions have been resilient and better than long term trends. Despite India's persistent outperformance, PE valuations of large-cap indices, e.g. the Nifty50, are close to their five-year means. This suggests that a rotation to large-caps is imminent and some caution in mid-caps is warranted bringing us to the important aspect that's valuations. Currently, valuations in India are expensive relative to the Asian peers and India remains the most expensive market (on both forward P/E and trailing P/B basis). The earnings outlook for India remains strong relative to the emerging markets. In terms of earnings growth drivers, healthy credit demand and bottoming margins in case of banks should lead to high earnings visibility and strong profitability over the next few years. Within non financials, robust high end consumption demand and recovery of private capex cycle recovery in the second half should drive earnings growth. Growth in the next few months is likely to be driven by election related spending which should boost consumption demand. Post elections, we expect investment growth to take centrestage particularly from the private sector. If the state elections are any indication, the risks from general elections are quite low and in our view policy continuity would set the stage for a further rally in equities. In the near term, slowing growth in the developed economies could exert pressure on external demand thereby acting as a drag on exports. We expect our currency to remain in a narrow range in light of manageable current account deficit, potential bond inclusion inflows and large forex reserves. Overall, India has the right ingredients in place to set the momentum further over the medium to long term. The big picture is suggestive of an economy that will benefit from long term factors such as improving infrastructure, manufacturing and the China plus one strategy ie curtailing imports and stepping up exports, formalisation of the economy and rising digitisation. India continues to be one of the few geographies globally that continues to record strong GDP growth with multiple positive drivers (as discussed above) in place to sustain it as well. This factor should continue attracting investors to invest in India. |

Source: Bloomberg, Axis MF Research.